If you’re doing research on financial services branding, then it’s likely you’re looking for inspiration and ideas.

What are some examples of financial services companies that are doing a great job with their brand?

While doing research on this topic, you’ll see a lot of websites showcasing well-known, large companies as examples of great financial services brands. JP Morgan and Citi have successful brands – but that’s because these companies are huge and well-known.

It’s hard to learn from a brand when the company is international and has a marketing budget 50x bigger than yours. What’s more interesting is learning about lesser known financial services companies that have managed to create a successful brand.

How do we define a brand? We like how Brent Beshore, founder of Permanent Equity, defines it: “A brand is more than logos and slogans, it’s a range of expected outcomes you can expect from any company or person… what you can count on, rely on, and plan around.”

Which is why a successful financial services brand doesn’t necessarily have to be internationally famous. And as we’ll see below, a successful brand also doesn’t have to be tech-first, social media savvy and follow all gen Z trends. A strong, tradition focused brand can be successful as well.

In this article, we’re going to go through 6 financial services companies that we believe are doing a great job with their brand. A few are well-known ones that you will definitely recognise, but there are a couple that you likely have never heard of before.

We’ll be looking at:

Note: join our newsletter to get updates every time we publish content like this!

1. Cash App: a brand focused on younger generations

Cash App is a P2P payment app that allows users to easily and quickly send money to each other for free. It’s owned by Block, formerly Square, and was launched back in 2013 to compete with mobile payments apps Venmo and Paypal.

What’s fascinating about Cash App is that their enormous investment in branding allowed the app to overtake the largest P2P payment app, Venmo in 2018. It is now one of the most downloaded financial app, and has taken financial services branding to a whole new level.

According to the BRAG (Brand Relative App Growth) report, which tracks how a brand impacts mobile growth, Cash App is one of the leaders, far in front of other fintech companies.

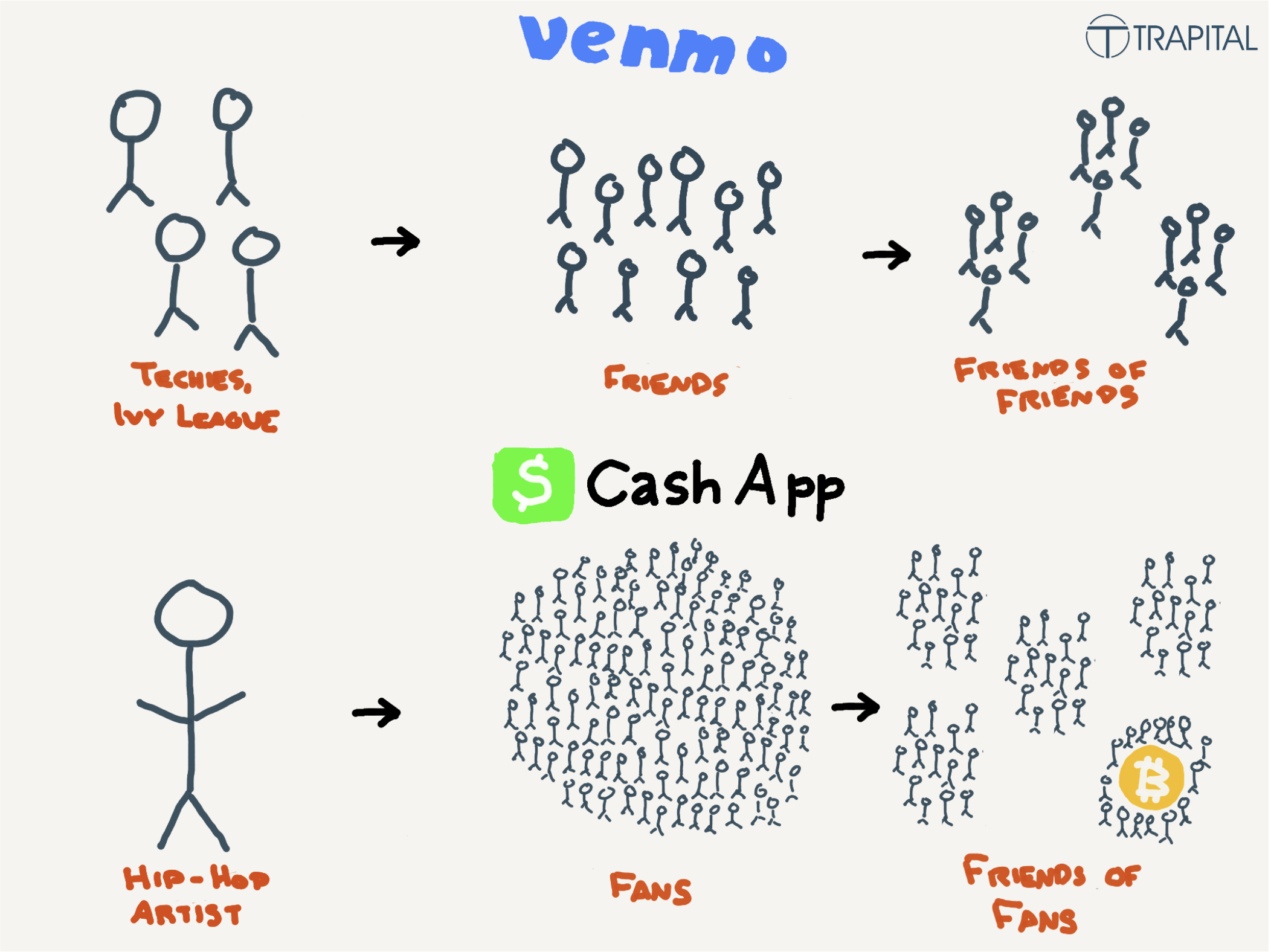

How did it overtake the well-known Venmo app in downloads and become so well known?

A big part is how much the company has invested in its brand. Cash App gained market share by first targeting millennials and Gen Z and by closely following social trends. They found success in collaborating with hip hop artists and decided to double down on the strategy. Some of the marketing efforts they did that helped them invest in brand and grow include:

- Social giveaways. They did “Cash App Fridays” where they would give out money to those who participated.

- Influencer marketing. They’ve partnered with very well known influencers such as:

- Cardi B

- Travis Scott

- Serena Williams

- Podcast advertising. They ran ads on the Joe Rogan Experience and Pod Save America.

- Partnerships. They partnered with some huge companies like Burger King and Animal Crossing

As mentioned above, they hit a target audience with gen Z and millennials in hip hop. According to Database Genius, more than 200 hip-hop artists include “Cash App” in their lyrics. As their Head of Marketing and Brand, Catherine Ferdon, says herself in an interview:

“Gen Z and millennials, along with early adopters in the southeast of US, have been the brand’s “sweet spot for a long time.”

Cash App made a mark by using a style of messaging that didn’t include interest rates and credit cards, and was very specific to Gen Z and millennials. Cash App is an example of a fintech company that is tech-first, disruptive, stays on top of trends and targets younger audiences – and has done it very successfully. A lot of financial services companies are adapting their branding and trying to target younger generations in a way that usually misses the mark. That’s not the case with Cash App.

When you think of Cash App, you think of: hip, trendy, cool. If you’re looking for examples of a financial services company that has successfully built a relatively new brand for the younger generations, Cash App is the one.

2. Piscataqua Savings Bank: a brand focused on generational legacy

You don’t have to be targeting younger generations to have a good brand, though.

As we mentioned earlier, a strong brand is about being predictable, reliable and specific. And Piscataqua Savings Bank is a great example of how a small community bank approaches this.

In the Against the Grain series by Jay Acunzo, Jay goes to Portsmouth, New Hampshire, to learn more about a bank that does things very differently. The bank is small and community-driven, and has been serving the town of Portsmouth since 1877. While all the other banks have been shutting down and leaving, this bank isn’t going anywhere.

It’s a bank where the staff remember your name, ask about your family and even have a “Kid’s bank”. As the CEO, Rick Wallis says in the interview, Piscataqua is different from other banks in focusing on community and being different from typical banks. They offer a sense of connectedness, community, belonging and place.

They reinforce that sense of connectedness in a few ways:

- Keeping the lobby area so they can welcome customers.

- Knowing customers by name and what they do for work.

- They only serve individuals and local businesses, not corporations.

- They only serve people who live within 25 miles of their office.

- They partner with non profits that support the community.

- They are a B Corp.

- They are privately owned and don’t have to answer to shareholders.

Their mission is to remain in place tomorrow and maintain a long term legacy. Their brand is about community, generational legacy and being in the long term rather than the short term.

When you think of Piscataqua bank you think of community, connectedness and generational legacy. If you’re looking for examples of financial institutions that are doing a good job maintaining a strong brand across multiple generations, this bank is a great one.

3. Monzo: a brand for challengers

Monzo was one of the first digital-only personal banks in the UK and their brand was key to standing out and growing.

Their branding strategy was: make it clear how different the product is. Instead of being on hold for 10 minutes, you can do a live chat. Instead of a multi page bank statement in the post, you got a notification. All these new types of features were reflected in their messaging and marketing. At a time when banks’ user experience was clunky and unintuitive, Monzo was a breath of fresh air in the finance industry. They wanted to make sure their brand experience reflected that.

Instead of stuffy banking ads and messaging, they took a page out of the playbook of tech brands like Uber, Netflix and Instagram. There are a few ways their brand image stood out:

- Using a hot coral card that stands out in a sea of black and blue.

- A casual, friendly tone of voice instead of stiff and corporate.

- An intuitive and customer-centric app rather than a confusing one.

They also did a great job of spreading their digital marketing brand guidelines on social media, including TikTok, Instagram and Twitter. We had a great chat with their social media manager, Richard Cook, a few years back about their approach to social media marketing: What's Our Social Media Approach and How Do We Make the Most of Each Platform? | Richard Cook, Monzo

In the UK, when people think of Monzo they think of: intuitive, friendly and customer-centric. A refreshingly different and unique brand made it easier for Monzo to get their first customers and grow to the 7.5 million customers they have in the UK now. They’re a great example of a financial services brand that used their brand to make it clear they were challenging the market and were different.

4. Frost Bank: a brand focused on tradition

Frost Bank, founded in 1868, is based in San Antonio, Texas, and is another success story of a financial institution that has built a brand centered around legacy and the long term.

As the Financial Brand describes in an interview, Frost Bank has one of the most consistent, creative brand identities in the financial services industry. Their brand is focused on long-term loyalty with modern Texans, and connects with them over values, commitment and purpose.

Their messaging, ads and creatives are focused on what makes Frost Bank’s brand values unique, and on the values of the cowboy: honesty, humility, loyalty and determination.

As the Financial Brand says in their article, most financial institutions aren’t comfortable with using marketing budgets for an ad that focuses on branding rather than pushing a product. But Frost Bank isn’t like that. As Pam Thomas, their Chief Marketing Officer says in the interview: “Frost Bank understands the value of focusing advertising communications on the brand.”

Watch one of their ads here:

In 2022, Frost earned the highest ranking for customer satisfaction in Texas in 13 consecutive years and earned multiple Greenwich Excellence and Best Brand Awards.

With Frost Bank, you know what to expect from the brand: Texan values. It’s a great example of a financial institution that has embraced its roots and traditions and turned them into a consistent brand.

5. Vanguard: a brand focused on loyalty

Vanguard is a financial institution that is the largest provider of mutual funds in the US, and it’s the only financial services company in the “Top 13 Brands of the Year with the Largest Equity Increases.”

How does Vanguard have such a strong brand identity? A bit part is its origin story. John Bogle founded Vanguard in 1975 with one fundamental idea: that an investment company should manage its funds solely in the interests of its clients. In other words, the investors should manage the fund, not fund managers.

Vanguard’s brand mission is very clear to whoever interacts with the company: it’s to stand up for the everyday investor. A lot of the interactions they have with customers reiterate the fact that they are investor first:

- They don’t cross-sell products.

- They focus on being as low-cost as possible.

- They have no shareholders.

- Their pricing is transparent.

To them, investing is not about money, it’s about individuals who want to feel confident and optimistic about their futures. The company has a huge focus on customer retention, and is known as one of the financial services firms with the most loyal customers.

The Vanguard brand was put in place right from the beginning with its unique business model and approach by John Bogle, which is still active today (and a big reason employees work there). When you think of the Vanguard brand, you think of: investor-first, low-cost and democratic. It’s another example of a great financial services brand if you’re focusing on customer retention.

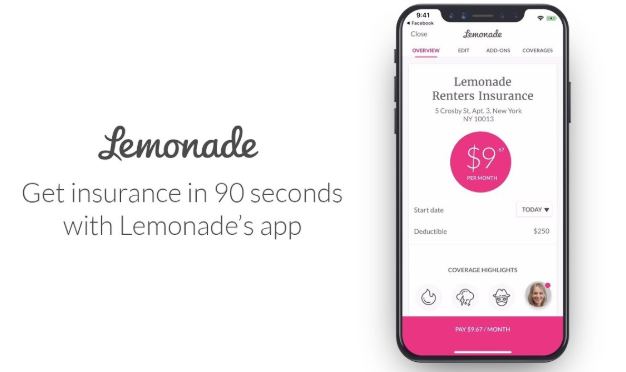

6. Lemonade: a brand focused on standing out

We finish off with another challenger financial services brand operating in a notoriously difficult space: insurance. Lemonade offers renters, pet, homeowners and other types of insurance and was founded in 2015.

Similar to Monzo, Lemonade uses its branding to make it clear that it's a challenger and that the company does things differently. In an industry that is notoriously obscure and complex, Lemonade appears with a much more refreshing brand. A few things they do differently:

- Transparent with their fees.

- It’s easy to sign up and cancel.

- Pay claims quickly.

- Gives underwriting profits to nonprofits.

They use a different model from other insurance companies and this is a big part of their branding: being a challenger. A big way to do that in insurance is being very transparent.

In the name of transparency, they’ve done other things, such as:

- Publishing their metrics.

- Taking a big stand on big topics like climate change.

- Defending their brand colors from Deutsche Bank.

This has resonated well with younger generations, which are its target market. You can head to their Instagram to see how they’re taking this challenger approach across all their social media channels.

Lemonade hasn’t been around as long as some of the other brands, but in the time they have been it’s clear that their brand stands for: transparency, challenger and customer-centric. They’re a great example of a relatively newer brand that is using its challenger business model to stand out and speak to younger generations.

Financial services branding: a great brand is predictable and ties in closely with its business model and origin story

As we’ve seen in these examples, a lot of financial services brands are successful because their branding is more than a brand: it’s their unique business model, origin story or the “why” behind the company. You can’t generate a great brand from thin air, it has to come with a great product and model as well.

It also shows that you don’t need huge VC dollars and to be a new, trendy startup to be great at branding. Many of the great brands are decades (even centuries) old and instead embrace tradition and what they’re known for.

What are some other financial services brands you think are worth including? Let us know and we’ll add them in!

Financial services branding Frequently Asked Questions

1. What makes a financial services brand successful?

A strong financial services brand is more than a logo or slogan — it’s the set of expectations customers can consistently rely on. Success comes from aligning branding with the company’s business model, values, and origin story, creating a clear and predictable customer experience.

2. Do you need a huge marketing budget to build a strong brand?

No. While large institutions like JP Morgan have strong brands, smaller and lesser-known financial services companies can also create impactful branding by focusing on authenticity, consistency, and their unique strengths — such as community legacy or challenger positioning.

3. How do challenger brands differentiate themselves in financial services?

Challenger brands like Monzo and Lemonade stand out by offering transparent, customer-centric experiences that contrast with industry norms. They use modern design, accessible communication, and disruptive business models to make their differences clear.

4. How important is targeting a specific audience in branding?

Extremely important. Cash App, for example, grew rapidly by targeting Gen Z and millennials with culturally relevant marketing, influencer partnerships, and messaging that resonated with younger audiences.