Great Fintech Marketing Strategies For 2024 (Featuring Top Fintech Marketers)

Marketing a fintech company isn’t like marketing any kind of company.

The main reason is because Fintechs have the reputation of the financial services industry to overcome: some banks being greedy, others being un-intuitive, and many not being transparent.

Financial technology companies need to market themselves differently in order to overcome these initial biases against the financial industry. Although partnerships with incumbents may be the best way forward, Fintechs still have a lot of work to do when it comes to marketing. What are some of the best marketing practices? That’s what I’ll be covering in this article.

Both B2C and B2B Fintechs are adopting a new kind of marketing, something the Fintech Marketing Podcast calls Business-to-Human; whether you’re a business or customer facing company, customers and clients want more modern interactions (at the end of the day humans are still your customers in B2B). Through my own experience helping Fintechs with their marketing, I believe there are three main pillars to Fintech marketing:

Education: most millennials and individuals find finances confusing or full of jargon, so Fintechs are taking on the role of educating customers.

Trust: banks and financial institutions don’t have great reputations, so Fintechs have even more work to do in order to build trust with their customers (education ties in well with this).

Customer experience: younger generations expect the same level of service they get with Uber, Google and Apple. Fintechs need to offer a personalised and intuitive user experience.

So what are some marketing strategies that can help both B2C and B2B Fintechs achieve those three pillars? I reached out to some Fintech marketing connoisseurs, did a little bit of research, a decent amount of thinking and put it all in this article for you to read. 👇

1. Get good at one marketing channel

The reason this is marketing strategy number one is for one simple reason: not every marketing strategy is suitable for your company. Yes, a lot of marketing is content driven nowadays, but that doesn’t mean your company needs to jump on every fintech marketing trend and host podcasts, webinars, video marketing and be on Snapchat at the same time.

For Fintechs that don’t have a huge amount of resources, it’s worth committing to a couple of marketing channels and getting good at them. Then, gather as much data as you can about your customers on those marketing channels. By doing this, you’ll be taking a data driven approach when jumping onto the next marketing channel: the data will be there to prove that this channel is worth investing in.

Marketing channels are not only a way to engage customers and promote your product, they are also a tool: the more you use a specific channel, the more you learn about what your customers want and therefore the more you can provide targeted content.

Once you’ve built a good audience and mastered one channel, you can then ask your audience: would you want a podcast? What about videos? By gathering data on your audience through one channel, you can more easily engage the next one - and you’ll already have an audience ready for you!

One example of a good B2B Fintech marketing approach is OakNorth; they only recently started engaging on social media platforms. When they first started, they didn’t bother with social media. Why? Because they know that their ideal customers were not on Twitter, Facebook and Instagram.

Instead, they attracted customers by hosting their own entrepreneur events. OakNorth grew to become the most valuable Fintech in Europe without social media. They understood where their high quality customers were hanging out and focused on that. Where do your customers hang out? 🤔

You may also like: Top B2B Fintech Marketing Tactics (with examples)

2. Publish educational content

There is one marketing strategy that I do believe is an exception to the above: a company blog. This is simply because publishing a company blog regularly is one of the cheapest and best ways to get more eyeballs on your website (and therefore product) and gather valuable information about your customers (if your customers use the internet, of course). The important part, of course, is getting the strategy right from the beginning so you make sure you’re gathering the right data (that’s what I help Fintechs with!).

For both B2C and B2B Fintechs, publishing educational content is a great marketing strategy. As mentioned above, the financial services industry is notorious for its huge amount of jargon, complex fee structures and lack of transparency.

Fintechs need to overcome this additional baggage in order to attract more customers, and one of the best ways to do this is through educational, jargon-free content. It’s a great way to add value to your customers - the first pillar of Fintech marketing.

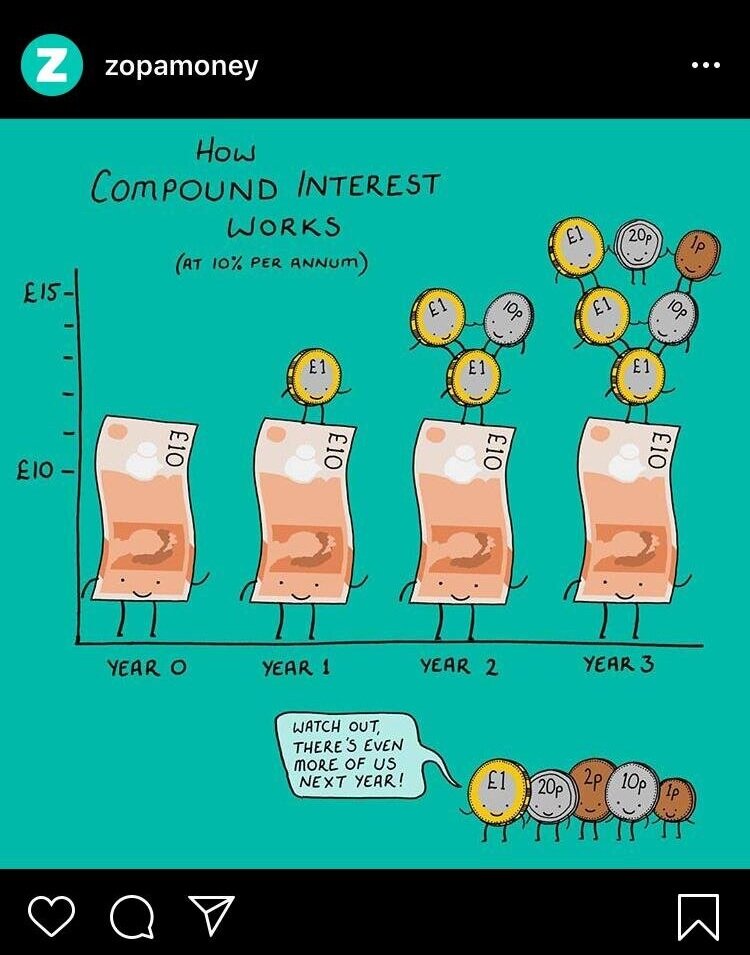

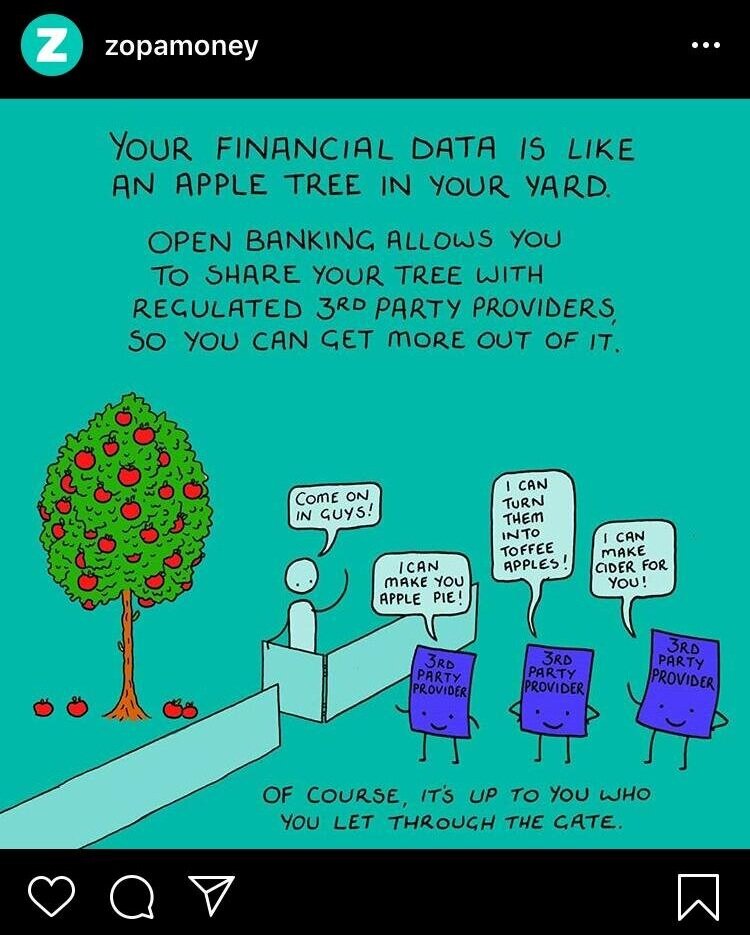

Educational content doesn’t necessarily have to be written on a blog. In fact, several Fintechs are publishing educational content on social media and turning finances into something fun and entertaining. My favourite Fintech example of this is Zopa’s Instagram strategy:

Marcel Van Oost, a Fintech agent and advisor based in Amsterdam, outlines Mint as a successful example of effective content marketing. Before even launching, Mint published a ton of content ranging from blog posts, to interviews, to infographics and many different types of content with targeted SEO and research. This resulted in their blog MintLife becoming one of the top personal finance blogs before they even launched their product.

3. Host events (online or in person)

The great thing about hosting events online or in person is that you don’t need to be a big, famous company in order to do it. With our own very small podcast, we’ve managed to host several in-person and online events, as well as a successful 4 day conference with our listeners last year. Anyone can host events, and the truth is that the benefits very much go both ways!

For both B2B and B2C Fintechs, hosting fireside chats and networking events in your company office is a great way to improve your Fintech branding and position yourself as a thought leader, if that is one of your goals. It’s also a great way to involve your own team, encourage new ideas and build a network.

At the beginning, hosting events might not put you in contact with your customers directly (most people who attend these events are most likely going to be other Fintech and tech nerds), but it will help you position yourself as a thought leader. More on that below.

Once your brand is a little more established, you will be able to host events and invite your actual customers. The customers that come will be brand evangelists: people who love your brand so much that they come to the events, tell all their friends about you and promote your product on social media. Revolut’s London #RevRally is a great example of this.

Read more: 6 Fintech Marketing Trends Happening in 2023

4. Position yourself as a thought leader

The main benefit of establishing yourself as a thought leader is something called leadership marketing. When you put your thoughts and opinions out there and host regular events, the media will come to you. Publications, writers and magazines come to you and want to feature you. And you know what that means? Your company and product reaches an even larger audience. Thought leadership acts like a megaphone for your brand. 📣

So how do you attain the highly acclaimed position of thought leader? It’s a marketing strategy that takes time, but the benefits can be huge. Thought leadership content can be publishing white papers and reports on your industry or customer habits. It can be publishing content that tries to answer the big questions (is there a future with invisible payments?).

It can be as simple as publishing three posts of other people’s content on social media for every one promotional post you publish. If you’re not sure where to get started, look at what your competitors are doing: what kind of thought leadership are they engaging in?

Thought leadership helps with the three Rs: Reputation, revenue and relationships. By publishing “big picture content”, you’re helping build a good reputation (something that is very hard to do, especially when reputations can be destroyed in an instant). You’re also building relationships (pillar one and two of Fintech marketing!) with your customers: you’re showing the world you care about the world and industry as a whole, not just your own company profits. And of course, over time, these tactics will help you increase revenue.

One Fintech I think that does thought leadership well is N26. I used to regularly go to the events they hosted in Barcelona, and I really like their magazine! Onfido also do a great job at publishing detailed and interesting white papers and case studies.

5. Do something bold or creative

As financial technology becomes more mass market, the harder it is for Fintech products to stand out. A saturated market means companies are leaning towards performing bolder activities in order to attract attention. If your company is struggling to gain a larger reach, doing something bolder could be a marketing strategy worth pursuing.

What type of “bold activity” should you do? This depends a lot on your product, on your branding and what you want to achieve. There isn’t really a guide on “how to be bold”, so I’ll just add some examples of Fintechs doing creative actions to stand out. The only thing to note is that you want to make sure what you do aligns with your brand and values.

A pretty well known one is WePay, who put a 600 pound block of ice with hundreds of dollars underneath in front of Paypal’s conference centre. Their message: Paypal freezes your account, so switch to WePay to “unfreeze” your money. According to the WePay team, this stunt increased WePay’s signups by 225%, weekly traffic by 300% as well as three times more conversions. Pretty cool.

Another example I like is Lemonade: Deutsche Telekom (not even an insurance company!) threatened Lemonade with a lawsuit for using a similar brand colour (Lemonade was new to the German market). After doing a bit of research, Lemonade realised Deutsche Telekom had a history of bullying any company that decides to associate their brand with the colour pink. Instead of backing down, Lemonade is now taking them to court.

Finally, a small but still bold move: Klarna does publish some pretty weird videos, but one I liked was titled “10 reasons you should not work at Klarna”. Yes, maybe a little bit clickbaity, but if there’s value in the content, why not?

You may also like: 9 Fintech Companies That Are Doing Social Media Right

6. Own your mistakes

I’ve talked about this marketing strategy before, and I have to say it’s one of my favourites. The story I usually tell is of the time when I had an issue with my Euro current account with Starling bank - they put me into overdraft by accident. It was a small mistake. But one week later I received a hamper in the mail with chocolate, cheese, cake and a bottle of lemonade and a message with “sorry for the issues you had with your Euro account”.

Wow! My traditional bank would never do something like that. By admitting their mistake and turning into a win, Starling gained a lot more of my respect. Lemonade also did something similar when they admitted to publishing an advert that was of bad taste.

One of the pillars of Fintech is trust, and one of the best ways to earn the trust of your customers is to admit your mistakes and show that you are turning them into learning opportunities. This further demonstrates two things: that you are genuinely listening to your customers, and that you are putting their feedback in action. For smaller companies, this is a huge competitive advantage over large incumbents.

7. Referrals

Over a video call, Thish from Their Perfect Gift talked to me about a popular marketing strategy amongst Fintechs: free money.

When playing the numbers game, free money really pushes those numbers up. Thish and I agreed that when combined with referrals, this strategy helps get large amounts of new customers in the door.

Marcel Van Oost describes in his weekly Fintech newsletter that using referrals is a great pre-launch strategy. He explains that Robinhood used this approach before even launching their product. Customers who wanted access to Robinhood had to join a long waiting list.

However, if they referred friends and encouraged others to join, they would be bumped up a few spots. The results were very impressive; a combination of gamification and the psychological aspect of “having first access to something cool” made it a huge success. Monzo and many other Fintechs have since adopted this strategy successfully.

Once your product is launched, offering an incentive (free money) that obliges people to open an account or use your service is. Robinhood eventually switched to offering small amounts of stocks that you only had access to if you opened an account. Monzo and Revolut offer a small amount of money in your account. Eric Novinson, seasoned financial writer, mentions that Paypal grew considerably because people needed to open a Paypal account in order to use the money they received.

8. Free online tools

Marcel Van Oost also outlines in this newsletter another great marketing strategy somewhat similar to the one above: free tools. The great thing about offering free tools rather than free money is that you’re increasing user retention (by adding value) as well as customer acquisition.

Credit Karma is a website that offers access to short-term loans. But 30% of their 5 million monthly visitors actually come to their website for their free online tools. Amongst those tools are the Debt Repayment Calculator, the Credit Score Simulator and more.

These tools help people fix problems and answer their questions. If the customer wants a more detailed analysis such as a historical credit report, they need to create a Credit Karma account. This is a great way to implement the third pillar of Fintech marketing: customer experience. Thanks to the big tech companies, customers expect free things all the time. Free tools are an opportunity to meet that demand.

These tools also meet the second pillar by adding value and building trust with users. Even after a customer has created a Credit Karma account, they can keep coming back to these tools and using them, making them feel like they are getting a good deal. Other Fintechs are using this same strategy such as Monzo, that will soon be letting users view credit scores for free in the mobile app. What are some tools that you could offer for free that could genuinely help your customers?

You may also like: 5 Neobanks That Are Doing Things Differently

9. A good story

Finally, Fintech product strategist Oliver Mitchell has another Fintech strategy that rings true to every marketer. His words:

“'What story does your product tell?'. For instance, absolutely nobody cares about cash flow forecasting [of your company], but LOTS of people want to know whether they can go out on the town the Saturday before pay-day. By focusing on the story behind the product rather than a dry description of the feature you can connect with potential customers FAR more deeply!”

Marketers and copywriters talk about this time and time again: focus on the benefits of your product rather than features. How does your customer feel? What’s in it for them? You want your messaging to be as clear as possible about the benefits of your product across every of your marketing channels. Oliver kindly shared some good copywriting examples that emphasise the importance of telling a story:

The second image is after the redesign of Offspring, where:

The story is much clearer - connecting with a behaviour that the segment has experienced ('cash in the birthday card') rather than an abstract wish ('create a community of savers')

The CTA is clearer and non-threatening ('Try it out- it's free')

The product in the graphic is to the right

The one thing I would add to this strategy is creating an authentic About page. I love writing About pages for Fintech companies: this is the place to talk about how the founders’ were dissatisfied with the status quo, were faced with a problem and how they set about finding a solution.

The about page is a great place to connect with customers on a human level; after all your company is made of humans as well! Simon Koci, Head of International Payments at Tapix, calls this social selling. Social selling is when you’re engaging with your users by getting personal; once again, this builds trust: an essential pillar of Fintech marketing.

This is a list of great marketing strategies; but as mentioned earlier, a Fintech does not need to do every single one to be successful. Pick one marketing channel and use it to gather data and engage with your customers. Once you feel confident you understand their preferences, needs and habits, then move onto other channels.

Social media may not always be the best place to allocate your marketing budget starting a podcast is not a surefire way to increase customer acquisition. Before going all in, test; before trying something new, ask.